Reading time: 1.10 min.

32 L. Koidula street investment opportunity was funded in 7 days!

Our 32 L. Koidula street was the first investment opportunity published and funded on our new IT platform and despite of small technical glitches, the overall process worked out fine.

Comparing 32 L. Koidula street investment opportunity to our previous funding campaigns, 1 week long campaign feels like eternity, but considering the circumstances related to replacement of IT system and the completely upgraded investment process (including the requirement of pre-funded investment account), we can consider it as an excellent result. The future probability of ultra-short funding campaigns (like our 4 minute long 5 Heina street funding campaign) is quite low as investors are required to transfer funds to their investment accounts before being able to invest, and SEPA payments between banks will take at least few hours.

32 L. Koidula street investment opportunity is our first collateralised project, where the Sponsor’s long-term experience and track record is supplemented by a first rank mortgage on 32 L. Koidula street property.

10% per annum return is the lowest return we have ever offered, but considering the first rank mortgage on the property, the return can be considered even a bit high. We believe, that the following collateralised investment opportunities should and will have lower expected yields dropping to 5 – 7% per annum.

Please find some statistical data about this crowdfunded project below!

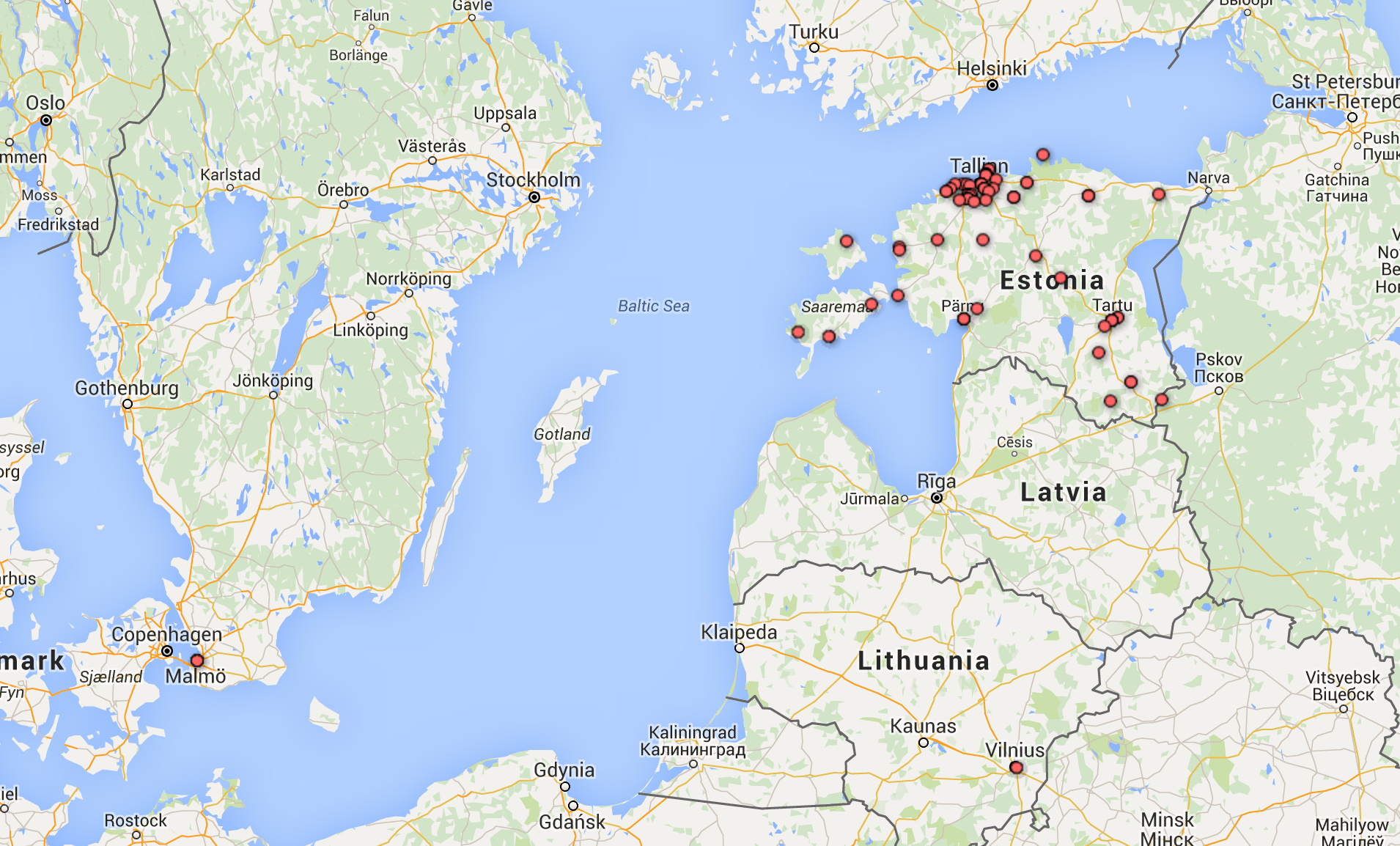

Geography

32 L. Koidula street investment opportunity was funded by Estonian, Lithuanian and Swedish investors.

Number of participants, investment median values

A record number of 250 investors participated in the 32 L. Koidula street funding campaign. The reasons for such a large number of participants is the long (1 week!) funding campaign and below average median and average investment amounts.

The median investment value to 32 L. Koidula street investment opportunity was 500 euros and the average investment amount was 1.660 euros. The smallest individual contribution was (again) 100 euros and the largest individual investment was 100.000 euros.

Private persons vs. companies

8,4% of the participants (171) in 32 L. Koidula street investment opportunity are private persons and 31,6% companies (79). However, 57,3% (237.650 euros) of funding came from companies while private persons contributed 42,7% (177.350).

Men vs women

66,4% of the participants were men (166) and 33,6% women (84).

80,9% (335,650 euros) of the total investment were contributed by men and 19,1% (79,350 euros) by women.

![Investeeringute suurused [ENG]](http://blog.crowdestate.eu/wp-content/uploads/2015/12/Investeeringute-suurused-ENG.jpg)

![Eraisikud vs ettevõtted EUR [ENG]](http://blog.crowdestate.eu/wp-content/uploads/2015/12/Eraisikud-vs-ettevõtted-EUR-ENG.jpg)

![Naised vs mehed EUR [ENG]](http://blog.crowdestate.eu/wp-content/uploads/2015/12/Naised-vs-mehed-EUR-ENG.jpg)

![Mediaansuurused [ENG]](http://blog.crowdestate.eu/wp-content/uploads/2015/12/Mediaansuurused-ENG.jpg)