The current economic environment and changes in banks’ risk appetites have yielded a very attractive return play for real estate crowdfunding investors.

We remember vividly the collapse of Silicon Valley Bank in March 2023, followed by several other closures of smaller US-based commercial banks. In early August 2023, Moody’s downgraded the credit rating of several small and medium-sized banks and placed several large banks on its credit downgrade watchlist.

These events have put the global banking industry under pressure and forced it to reconsider its lending strategies to mitigate risk and appease regulators, investors, and depositors.

At the same time, major central banks are continuing with their interest rate hikes, and even though we see the rate hikes ending eventually, the high base rates are not expected to drop sharply shortly.

Several trends are emerging from this pressure, the most important of which is the banks’ forced reduction of real estate credit exposure and offloading of distressed loan portfolios. Both trends seem to benefit specialist institutions and retail crowdfunding investors.

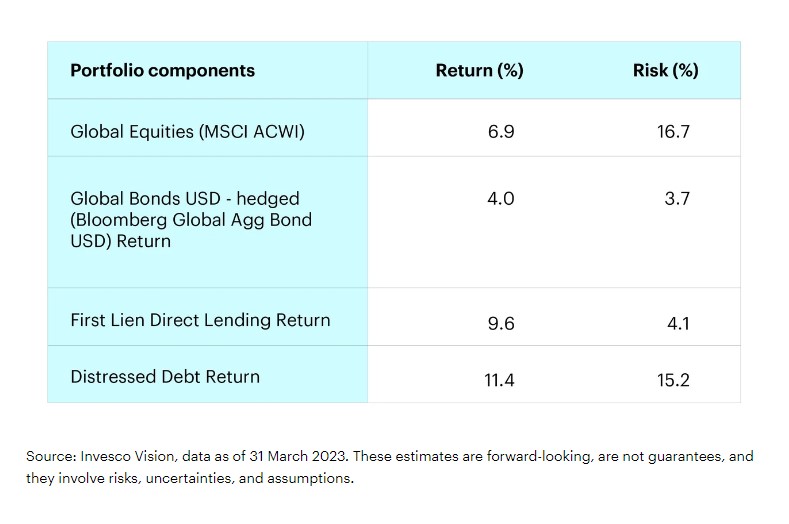

In recent research published by Invesco, industry experts have provided forward-looking views on asset classes’ return estimates and riskiness. The riskiness of equities and their about 7% p.a. return expectation are not surprising. At the same time, historically low-yielding global bonds are now expected to provide a 4% annual return, combined with quite modest risk.

Interestingly, distressed debt’s risk level is now almost equal to equities but is expected to return almost twice that of equities. While there are lots of institutional investors eyeing the distressed debt market, and we have been talking to several of them as well, there are no crowdfunding platforms (yet) that would provide retail investors with exposure to distressed debt. Also, while distressed debt is now statistically a better investment than equities, it might still be too risky for retail investors. Therefore, we believe that distressed debt will remain a realm of institutional investors, and retail investors should focus on mortgage-secured direct loans.

The global mortgage-secured direct loans now provide a whopping 10%+ annual return with risks almost as low as a global bond portfolio. In other words, at 4x less risk than the equity market, mortgage-secured loans are expected to provide 2x more return than equities.

All this is good news for crowdfunding investors.

At Crowdestate, we provide our investors with carefully selected, EUR-denominated, senior mortgage-secured crowdfunding loans with less than 50% LTVs and up to 16% annual returns from European real estate projects. Locking in those great rates as long as they last would provide a nice upside to the investors’ overall portfolio returns.

Summary

- The banking sector is under pressure and is forced to reduce its risk exposure, especially in real estate loans and distressed assets;

- The reduction of money supply in the secured real estate loans sector has resulted in the increase of interest rates and created new attractive investment opportunities for real estate crowdfunding investors;

- The distressed assets sector has a very interesting risk-return profile but remains unavailable for the retail investors;

- Mortgage-secured real estate loans are now providing 2x more returns at 4x less risk than equities;

Do you already have mortgage-secured real estate loans in your investment portfolio?

Investing in mortgage-secured real estate loans via Crowdestate is simple and straightforward. You can easily build a diversified secured mortgage loan portfolio with just a few thousand euros and a few minutes of your time.