From time to time, we receive questions like “How does Autoinvest work?”, “What is the best way to set up an Autoinvest?”, “How do I manage my investment portfolio with Autoinvest?” and “I want to deposit a larger amount, but I do not want to take too much risk?”.

We have published a blog post, “Ultimate Guide to Autoinvest 2.0”, earlier to explain the key elements and risk limitation features of our new Autoinvest, but what would be a better guideline to setting up your first Autoinvest or amending your current one than looking at a few real-life Autoinvests in action?

My portfolio at Crowdestate

I have been investing with Crowdestate since the beginning and in almost every crowdfunding offer published on Crowdestate. This means I have invested in dozens of earlier high-risk/high-reward real estate equity projects, hundreds of lower-risk/lower-reward secured loan offers, and failed corporate finance and real estate development projects.

My current (as of September 2023) Crowdestate portfolio is split between one main investment portfolio and 3 smaller portfolios, one for each of my three kids. The total combined value of these portfolios is about EUR 200,000, with a main portfolio worth about EUR 170,000 and smaller portfolios worth about EUR 10,000 each.

To get a good overview of each portfolio, I have opened four different investment accounts, one for each portfolio, and I have set up a separate Autoinvest for each account.

My risk policy

As a starting point, it is important to note that since March 2023, when Crowdestate became a fully licensed European crowdfunding service provider, the regulation allows us to use Autoinvest only for automating our investors’ investments in loans, and the previously available equity option is not available in Autoinvest’s setting any more. This means I must manually invest in any real estate equity project published on Crowdestate. As equity investments are riskier than mortgage-secured loans, this makes sense – I would like to read and digest any equity investments before making the final investment decision.

My most important concern when building an investment portfolio with Crowdestate (and it also applies to other investments) is achieving good diversification. When I automate my investments using less than 10 parameters, I do not want my portfolio to be tilted towards one or a few investments.

The optimum level of diversification is a matter of personal preference. Some people may feel comfortable with a lower level of diversification, while others may prefer a higher level. There is no good scientific research on the optimum number of investments in a crowdfunding real estate portfolio. Still, a general consensus is that a crowdfunding investment portfolio should include at least 20 – 25 different crowdfunding offers. I think the diversification level should be even higher, meaning that my portfolio should be diversified as much as possible.

As Autoinvest manages my investments in mortgage-secured real estate loans, my second important risk-limiting criterion is LTV (loan-to-value ratio).

There are three things to consider when thinking of the LTV ratio:

- Generally, a lower LTV ratio means the Project Owner’s larger equity contribution, making the loan less risky for the lender;

- A lower LTV ratio means the lender has less risk if the Project Owner defaults. If the case of the default, the collateral property will be sold off, and the sales proceeds will be used to pay off the Project Owner’s debts. The lower the LTV, the lower the property’s sales price needed to pay off the claims of mortgage-secured creditors.

- At the same time, a lower LTV ratio is often associated with lower interest rates as lenders are happy to charge less interest for less-risky loans.

Therefore, setting the highest permitted LTV becomes an optimisation exercise:

- If I set the highest permitted LTV too low, my Autoinvest might not find any loans at all, or if it finds some, the interest rate might be quite low

- If I set my highest permitted LTV too high, my portfolio might be composed of too risky loans.

Again, there is no single right answer here – for some lenders, the maximum permitted LTV might be 60%, and for others, 80%. Most commercial banks feel comfortable lending 70 – 80% against the collateral, with many US-based banks happy to go up to 90% LTV.

Third, I use additional risk-limiting criteria to control my investment exposure:

- I limit my risk to one single crowdfunding project;

- I limit my risk to one single Project Owner;

- I limit my risk to different Project Owners who are owned by one and the same person.

Finally, I’m using Crowdestate’s risk category to restrict automatic investments into higher-risk crowdfunding offers. My personal risk tolerance is relatively high, and I’m actually happy to invest in Crowdestate’s crowdfunding offers with risk category “E” (in fact, most of the equity projects would fall into this category). Still, I would like to review them manually before making an investment decision.

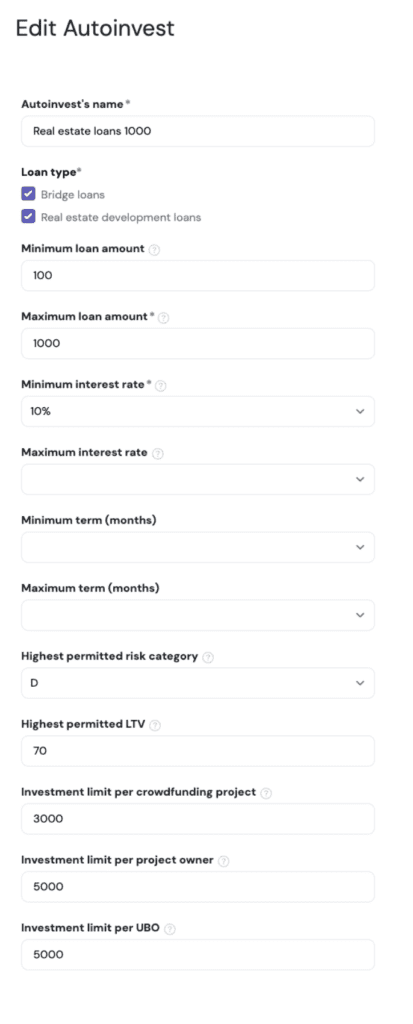

Now, let’s take a look at my main portfolio’s Autoinvest settings.

My Autoinvest settings

Based on my risk tolerance, my Autoinvest has the following parameters:

Loan type:

Although both are mortgage-secured real estate loans, bridge loans and real estate development loans have very different risk characteristics. With no intrinsic cash flow to repay the debt, bridge loans are pure LTV play. Real estate loans have intrinsic cash flow, but the generation of cash needed to repay debt is related to real estate market risks (e.g. demand for a specific product, at a specific price point, at a specific location, etc.).

I have allowed Autoinvest to pick both types of loans for my portfolio.

Minimum loan amount:

I’m using Crowdestate’s minimum investment amount of EUR 100 here.

Maximum loan amount:

I have set the maximum loan amount per crowdfunding offer at EUR 1,000. As many crowdfunding projects have multiple offers, I’m additionally using an “Investment limit per project” to limit my investment exposure against one. As you will see below, my “Investment limit per project” has been set to EUR 3,000, meaning that for larger multi-offer crowdfunding projects, my Autoinvest participates in the first three crowdfunding offers of the project, investing EUR 1,000 into each of the first three offers, and then stops investing there.

Minimum interest rate:

I wouldn’t mind leaving this parameter undefined. Still, as this is one of the two mandatory minimum parameters stated in the European Crowdfunding Regulation, I have set it to 10%. If the interest rate is 10% per annum or more, I’m happy to invest.

As long as the platform interest rates stay current, I must keep an eye on this parameter. When the interest rates start to decline and fall below 10%, I might need to reduce this number to 7-8% to be able to invest in lower-risk/lower-return loans and keep my investment portfolio diversified.

Maximum interest rate:

I do not want to limit my earning potential, so I have decided not to define this parameter.

Minimum term:

Some investors might want to lock in longer, high-yielding investments – in such a case, they can use this parameter to establish the shortest term of any loan they would be willing to invest in.

As my portfolio is currently having a cash drag, I’m also happy to invest in short-term loans, and so I have decided not to define this parameter.

Maximum term:

Some investors might want to limit their investments in long-term loans. In such a case, they can use this parameter to establish the longest term of any loan they would be willing to invest in.

Again, as there are rarely any loans longer than 18 months on the platform right now, I have decided not to define this parameter. Should there be a trend towards long-term loans appearing on the platform, I would probably consider setting this to 36 – 48 months.

Highest permitted risk category:

We touched on the subject of risk categories above, and I have decided to limit my Autoinvest in investing automatically in loans with risk categories from A to D. Should there be a loan with risk category E, I would like to review the specific crowdfunding offer before making the investment.

Highest permitted LTV:

I have decided to allow my Autoinvest to invest automatically in loans with LTVs up to 70%. If a loan has a higher LTV, I would like to review the specific crowdfunding offer before investing.

Investment limit per crowdfunding project:

My investment limit per crowdfunding project is set at EUR 3,000. Combined with a EUR 1,000 investment limit in each crowdfunding offer, it means that for larger multi-offer crowdfunding projects, my Autoinvest will participate in the first three crowdfunding offers of the project, investing EUR 1,000 into each of the first five offers, thus giving me a EUR 3,000 total exposure against any single crowdfunding project.

At the current value of the main investment portfolio, this means my investment portfolio is diversified between at least 55 different crowdfunding projects.

Investment limit per project owner:

In certain cases, the same project owner might execute several different real estate projects simultaneously. Although those projects might be individually viable, keeping them in one legal entity will result in additional execution risks – theoretically, problems with one project might harm the execution of other projects. Therefore, limiting the investment exposure against one project owner might make sense.

I have set my investment limit against one project owner at EUR 5,000. When I combine it with my EUR 1,000 investment limit per crowdfunding offer and EUR 3,000 investment limit per crowdfunding project, I might end up investing EUR 3,000 in the first three crowdfunding offers of one and EUR 2,000 in the first two crowdfunding offers of another crowdfunding project executed by the same project owner. Should the same project owner publish a third crowdfunding project, my Autoinvest will skip that one until the existing exposure is reduced below established thresholds.

Investment limit per UBO:

One person might own several companies that are executing different real estate development projects simultaneously. Riskwise, these projects are legally and financially separated but connected via the same beneficial owner. Should something happen to this beneficial owner, the event will affect all his projects. Therefore, limiting the investment exposure against one controlling person might also make sense.

I have set my investment limit against one UBO at EUR 5,000, which means that my risk against one specific person behind various crowdfunding projects, regardless of whether they are executed by the same project owner or separate ones, shall never exceed EUR 5,000.

At the current value of the main investment portfolio, this means my investment portfolio is diversified between at least 34 different beneficial owners.

Summary

- The key to building a healthy investment portfolio is diversification. Diversify between crowdfunding projects, project owners as well as the persons running different project owners;

- Use Autoinvest to remove emotions from investment decisions. It is human to be blinded by high returns – be tilted towards investing in higher-returning crowdfunding projects and ignore the underlying risks. Leaving control to algorithms will eliminate the risks of subjective decisions;

- Start from the target value of your investment portfolio and try to slice it between different crowdfunding projects and project owners. Find your comfort zone before defining your AUtoinvest parameters.

- Use LTV as the main parameter to limit your risk against one collateral;

- Use Autoinvest to align your investments with your investment strategy and automate your investment activities;

- Do not copy my Autoinvest settings above, as they might not be aligned with your investment preferences.