Reading time: 7 min

On Crowdestate crowdfunding platform we’ve used a pre-booking system but in some of the future projects, we will turn into interest auction solution. Here’s an explanation of what is an interest auction and how does it affect the investing process.

Shortly

Companies seeking funding can use our interest auction functionality to potentially reduce their interest expenses. Interest auction is a Marketplace where Crowdestate has used your loan application and submitted collateral data to set the initial maximum interest rate of your loan. Crowdestate’s investors will be bidding for the winning interest rate throughout the funding campaign and only investors with the lowest interest rate bids can participate in funding your loan. The winning investors and the final loan interest rate are determined upon the completion of the funding campaign.

In-depth

The interest rate for the funding campaign will be determined as a result of underbidding in the course of a reverse interest auction carried out through the Crowdestate platform.

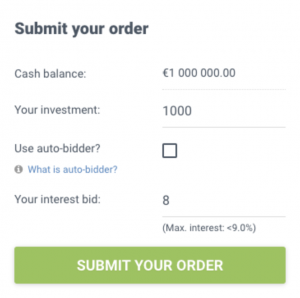

By entering a loan amount and an interest rate at the auction and confirming a desire to grant a loan, you will make an offer to lend to the Sponsor a loan in the loan amount specified by you in the offer, at the interest rate indicated by you and in accordance with the loan agreement, which you will find in among prospect materials. (please see the example below). Submission of the offer shall be binding to you and you will be unable to unilaterally withdraw or cancel the offer.

At the auction, you can make offers only in the rate that is equal to or lower than the starting interest rate of the auction (the interest rate shall be offered with the accuracy level of 0.1%). The number of offers you are able to submit is not limited. The loan amount has to be at least 100 euros or a multiple of one hundred euros and can not exceed the maximum loan amount.

In case there are offers made at the auction by other lenders with lower interest rate than your offer indicates or other offers are equal to your offer, but those offers were made earlier, and such offers in total make up at least the maximum campaign amount, your offer will cease to have effect and you will not be able to make an investment in this opportunity.

In case the sum of the effective offers exceeds the maximum campaign amount and your offer has the highest interest rate when compared to the other offers and is made later than the other offers with the equal highest interest rate, your offer will cease to have effect in the amount, to the extent to which the total amount of the effective offers exceeds the maximum campaign amount.

In other words, the offers with a lower interest rate, and thereafter offers with an equal highest interest rate that is made earlier will remain effective within the maximum campaign amount.

The effective interest rate for a funding campaign will be the interest rate specified in the effective offer with the highest interest rate, applying to all investors.

The Sponsor gives its conditional acceptance for the conclusion of loan agreement with investors who have submitted effective offers and on the conditions specified in the loan agreement. The acceptance will be binding to the Sponsor and it cannot be unilaterally withdrawn or cancelled.

The acceptance shall enter into force with regard to the offers that are effective at the closing date of the auction, provided that, at the closing date of the auction, there are effective offers made at least in the minimum campaign amount. In this case, the loan agreement will be automatically concluded between the Sponsor and the investors from the closing date of the auction.

After the conclusion of the loan agreement, a document of the agreement shall be automatically generated, in which the date of conclusion of the agreement, the loan amount and the effective interest rate will be disclosed.

In case there are no offers made at the auction in at least a minimum campaign amount by the auction closing date, the Sponsor has the right to extend the auction by 7 calendar days.

In case the Sponsor does not extend the time limit or in case there are no offers made in at least a minimum campaign amount, offers made by investors will cease to have effect and loan agreements will not be concluded.

Autoinvest and autobidder

When you open the project you can choose between 2 options – make a one-time offer manually or to allow an autobidding to invest for you (which, if necessary, updates the interest on the offer within the specified interest rate).

When setting up your Autoinvest you marked down the minimum and maximum return on a project. In the interest auction, Autoinvest (where the autobidder function has been added) will invest for you considering these values.

At first, Autoinvest will present the investment order with a maximum return (interest rate). Depending on the offers of other investors, Autoinvest will, if necessary, make offers with a 0.1 point lower return in the same amount as long as the minimum return is reached.

An example

Crowdestate has allowed the Borrower (Sponsor) to apply for a EUR 450.000 loan with the initial, maximum interest rate of up to 12%. The following bids were received during the funding campaign:

A. EUR 150.000 at 10% interest rate;

B. EUR 200.000 at 10,5% interest rate;

C. EUR 150.000 EUR at 11,2% interest rate;

D. EUR 200.000 EUR at 11,5% interest rate;

E. EUR 100.000 EUR at 12% interest rate;

F. EUR 150.000 EUR at 12% interest rate.

The total amount of loan offers in the amount of EUR 950.000 exceed the Borrower’s maximum loan amount, so the loan amount will be filled with the winning bids, starting from the lowest bids. Bids A and B have the lowest interest rate and will participate for their full amount, EUR 350.000. Bid C will participate in the remaining available amount of EUR 100.000 and EUR 50.000 from that bid will be discarded.

All included bidders will receive the rate the final participating winning bidder was asking, i.e. bidder C-s 11,2%.