Reading time: 3 min

When investing in different Crowdestate investment opportunities you have definitely noticed Crowdestate’s Risk Rating under SWOT analyses. In this post, we are going to explain what do the different categories under the Crowdestate’s Risk Rating mean so it would be easier to understand.

As an example, we are going to take the Italian project Cohousing Chiaravalle: https://crowdestate.eu/opportunity/cohousing

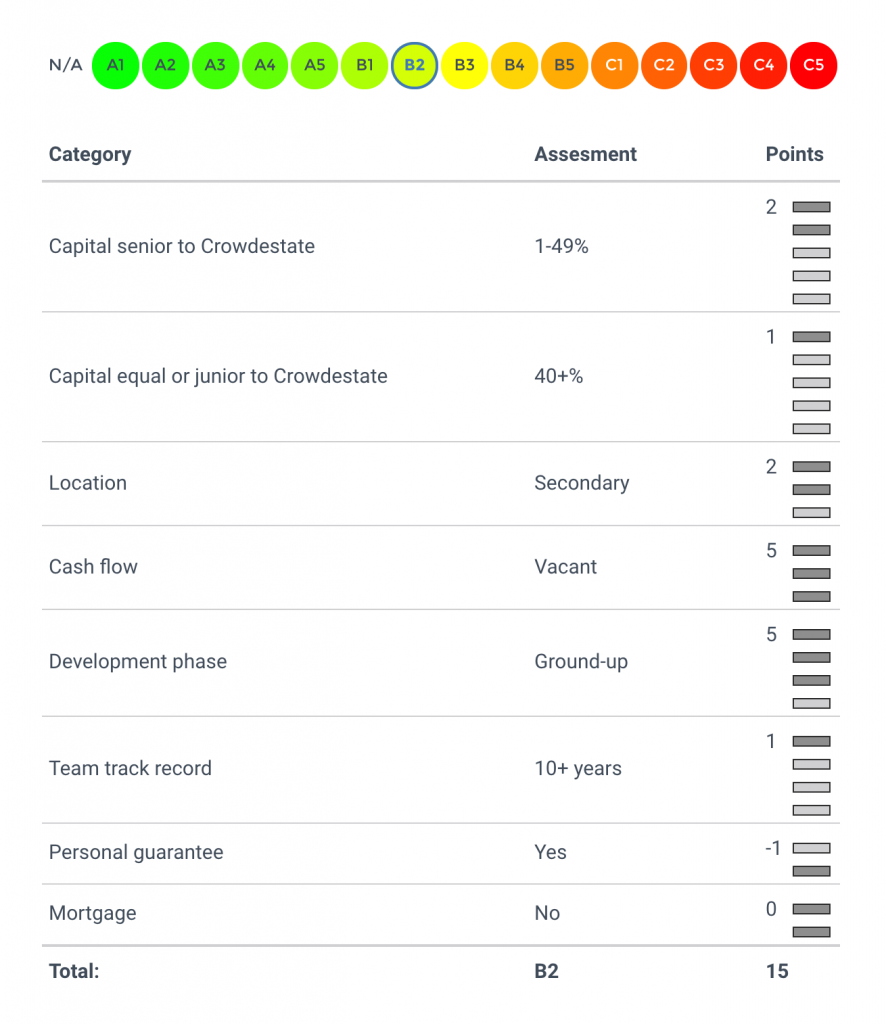

Here is the Crowdestate’s Rating where the A1 means it’s very safe and C5 that it’s very risky. Cohousing project is in the middle – B2:

1. Capital senior to Crowdestate

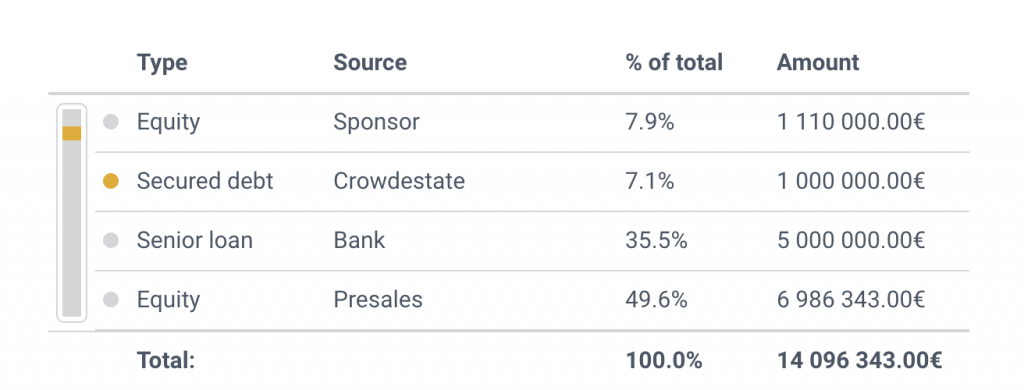

The amount of capital that is going to be repaid before the crowdfunding loan (usually the bank loan has the main priority). See the capital structure.

2. Capital equal or junior to Crowdestate

The amount of capital that is going to be repaid together or after the crowdfunding loan (usually the Sponsor equity is the last capital layer to be repaid). See the capital structure.

Calculation is made on the total amount of the project:

Capital to repay before Crowdestate loan = 5M / 14M = 36%

Capital to repay after or together Crowdestate loan = 8M / 14M = 57%

3. Location

The project is located in Milan (the main Italian business city) in a currently under transformation area, a few kilometres from the city center. That’s why it’s a secondary location.

4. Cash flow

The construction phase just started, so the property is not generating any positive cash flow at the moment and therefore it’s vacant.

5. Development phase

Sponsor has already started the construction phase, which is still at the initial stage.

6. Team track record

A very well know real estate developer with a proven experience of more than 20 years and several projects developed in Milan and other Italian cities.

7. Personal guarantee

This investment opportunity is secured by the owners’ personal guarantee in the amount of 350 000 EUR.

8. Mortgage

There’s no mortgage. Crowdestate owns 25% of the company’s shares.

A SMALL REMINDER

The above-mentioned rating expresses Crowdestate’s subjective view of each investment opportunity’s total risk level. Crowdestate Rating does not account for specific investor’s risk tolerance and is not meant to serve as a replacement for individual due diligence. Crowdestate Rating has no relations to ratings issued by international rating agencies nor to their rating methodologies.

Crowdestate Rating is an expression of investment opportunity’s aggregated risk level, calculated as a sum of qualitative and quantitative evaluations of the opportunity’s different parameters. Amongst other criteria, Crowdestate Rating considers investment opportunity’s capital structure, financial leverage, location, stage, cash flows, teams’ track record, collaterals etc.

Ready to invest? https://crowdestate.eu/register