Tõnu Toompark, Kinnisvarakool.ee

The war started by Russia in Ukraine is the main factor determining the future prospects of the European and Estonian economies. Market participants and forecasters expect tensions to persist. Understandably, the situation on the battlefields in a week, a month, or two is unpredictable.

The real estate and narrower housing markets are moving in the shadow of ignorance and ambiguity. Below, we analyze the current processes in the economy and the housing market to anticipate possible future developments.

The economy is close to zero

Economic growth in 2021 was strong, 8.6%. However, this has been declining compared to 2020, i.e. the year of the corona. At the end of 2021, we felt a rapid and significant rise in energy prices in our wallets. The rising electricity, gas, and petrol prices created fragile inflationary pressures.

February dropped forecasts on already weak ice. The start of Russia’s aggression meant that all previous economic predictions could be discarded. The unpredictable course of the war means that none of the following visions is of much greater value.

However, the Ministry of Finance, Eesti Pank and commercial banks must perform their duties and have something to think about what the future holds in today’s vague picture. In March 2022, public sector institutions have assumed that this year’s economic growth will be close to negative. Swedbank, SEB Pank, and Luminor expect a positive result of just over zero.

From the point of view of the real estate market, the economic cycle and the real estate cycle go hand in hand. Thus, it can be predicted that the significant cooling of the economy will slow down the real estate market in 2022.

Inflation is a crucial problem

An inflation rally was launched in the second half of 2021. At the end of the year, electricity and gas prices multiplied people’s housing costs. Sanctions following the Russian invasion of Ukraine in 2022 have severed energy and logistics chains. This means an increase in transport costs and a rapid rise in prices, i.e., inflation.

The general rise in the price level is pinching all consumers. This reduces people’s ability to raise self-financing for new real estate. In addition, servicing an existing or new loan takes less time.

Inflation rates that exceed wage growth and, in fact, expenses, which rise significantly faster than the growth rate of the consumer price index, reduce people’s purchasing power and, therefore, their ability to participate in the real estate market.

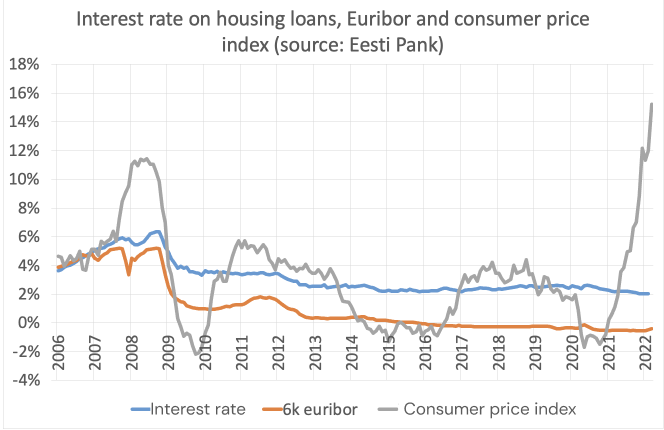

Inflation is linked to interest rates

In January 2022, there was a growing voice about ending the European Central Bank’s money supply and raising interest rates, which could happen in 2023. In the first half of February, it was already said that we would see an increase in interest rates in 2022.

On February 24, 2022, Russia began aggression against Ukraine. In fact, sanctions have affected the whole of Europe, if not the whole world. Raising interest rates in a state of war and thereby reducing business investment, which is rising unemployment and increasing the debt burden of private individuals in the face of decades of high inflation, is not a pleasant option. Rising interest rates are also a threatening thunderstorm over the wine-drinking countries of southern Europe, whose public debt is enormous.

An alternative to raising interest rates seems to be a longer-term acceptance of inflation. This, in turn, is particularly painful for people living in predominantly rented premises, such as Germans. The European Central Bank does not have good options.

On April 12, 2022, the 12-month Euribor jumped to the positive side of the year. The 6-month Euribor in common use in Estonia rose close to -0.3% from -0.5 per cent six months ago. The direction of the 6-month Euribor is clearly up.

As long as Euribor remains below zero, there will be no excessive impact on borrowers. The subsequent positive key interest rate will increase monthly loan payments. The higher loan payment is the next mouthful of the consumer’s wallet after the inflation one.

Can the optimism of the housing market be hit?

The housing market shook two years ago when a coronavirus arrived, and a state of emergency was declared. In a few months, by the summer of 2020, it was clear that we would be bought out of the great crisis by keeping money and interest rates low.

Instead of moderately raising consumer prices, the money supply reached, among other things, the real estate market. The number and turnover of residential transactions in Estonia in 2021 were record-breaking. The high demand, which could not be covered by the offers, was accompanied by a shortage of offers, which pushed prices up.

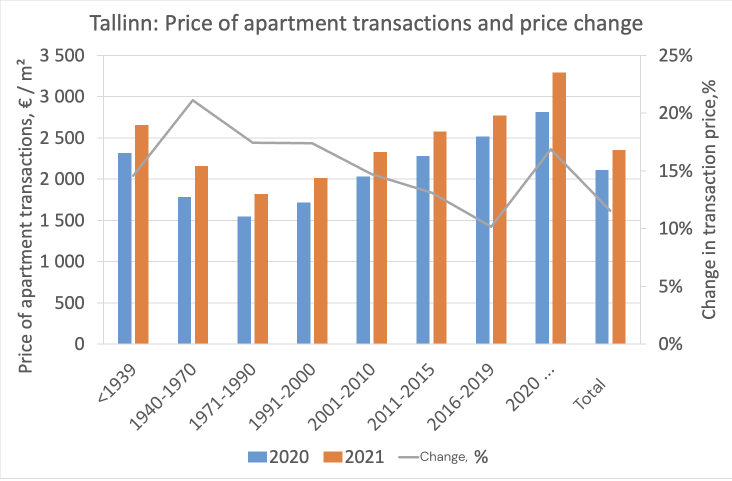

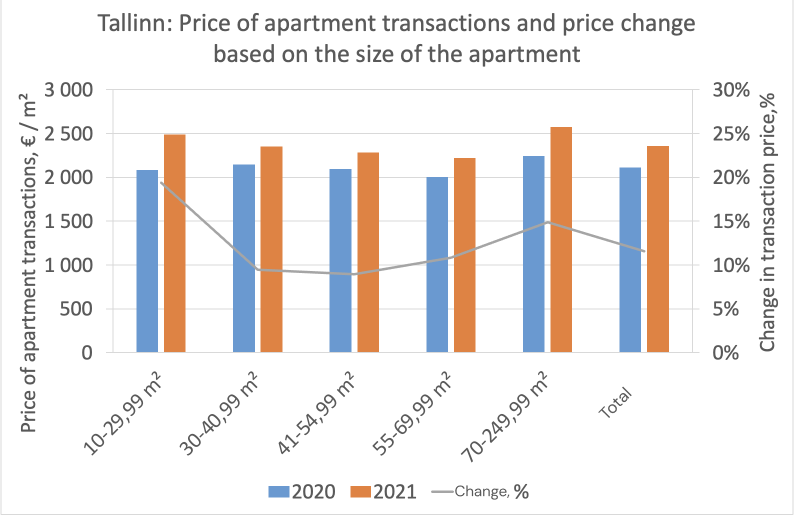

Apartments became more expensive in all segments

The activity of the apartment market has been general. There has been a great demand for apartments in all segments—apartments in different locations, apartments of different ages or qualities, and apartments with different numbers of rooms.

Global high demand has pushed up prices in all apartment market segments. During 2021, the equivalent cost of housing in Tallinn increased by an estimated 20-30%. In the case of smaller centres of attraction, the rate of real estate appreciation could be even higher.

In general, the prices of apartments in different segments of Tallinn are moving in the same direction and at the same pace. At the beginning of 2021, the prices of older apartments, which stalled in 2020 due to the corona, caught up with the market prices of newer apartments. The further movement of Tallinn’s apartments has taken place at a fairly steady pace.

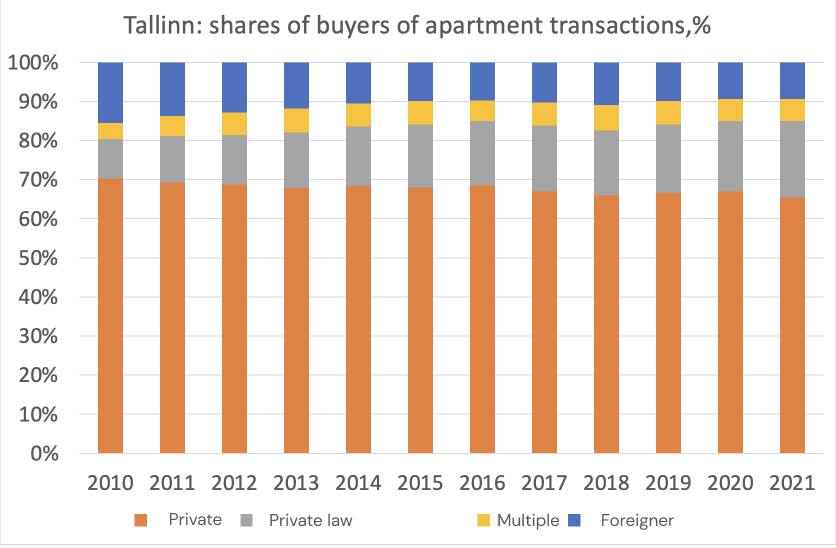

Rental investors were active

In the apartment market in 2021, buyers from legal entities increased their share on the buyer side. In 2010, the share of apartment buyers who were legal entities was ~ 10% of the buyers. By 2021, the share of buyers from companies has already grown to 20 per cent.

Rental Investments are also made by private individuals. Thus, a bold conclusion could be drawn that the share of rental investors on the purchase side of the Tallinn apartment market is approximately 25%.

The increased share of rental investors has been an additional factor in creating a housing shortage. If the home buyer puts the old home up for sale after purchasing a new home, the rental investor will not increase the supply in the secondary market when making the purchase transaction. This, in turn, has put additional upward pressure on prices.

Developers and builders are in trouble

By the second quarter of 2022, the great concern of developers and builders, ie the problem of the availability of construction materials, has not been resolved. Sanctions imposed on Russia have significantly reduced the availability of construction materials. The scarcity of materials and their rising prices are driving up construction prices.

The prices of new housing offered by developers are directly related to expenses. As input expenses rise, so does the selling price. Over the years, the market for new developments has grown large enough to influence the price trend of the entire housing market. Thus, the prices of older dwellings are moving in the same direction and at the same pace as the development of new buildings.

In a high-inflation environment, it would also be wrong to think that if all other goods become more expensive, the price of housing should go down. Unless the rockets start landing in Estonia…

Refugees have brought extra demand

The developers, or the supply side, are in trouble. On the other hand, demand has expanded significantly in the form of refugees who have come to Estonia. Some war refugees from Ukraine come to friends and relatives, others to temporary premises provided by the public sector, and a third to the rental market. Some individuals may have lost their way in the housing market.

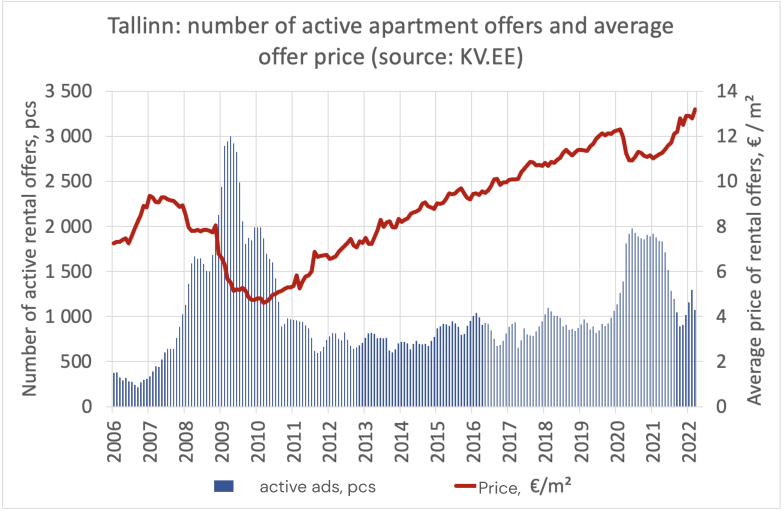

The number of rental offers for apartments in Tallinn decreased substantially twice compared to the beginning of March. In conditions of declining supply, a large wave of rental demand has pushed up rental prices. Despite the price increase, it is not possible to bring the rental offer to the market because there are simply no vacancies.

Thus, rental prices, especially the prices of cheaper apartments, have risen by an estimated 20-30% compared to a year ago.

Life gets harder, but you won’t run out

The outlook for future developments in the housing market and the economy as a whole is blurred. One Russian terrorist missile may be flying in the wrong direction when the whole world is to be reinterpreted. Therefore, it is reasonable to evaluate ongoing processes instead of long-term views.

The demand in the rental market is high and will remain high, pushing up rental prices. With some delay, the surge in rental prices could reach the cheaper end of the more expensive apartments sector in Mustamäe-Lasnamäe-Väike-Õismäe. The hope of rising rents could activate bolder rental investors for new investment deals.

The apartment development market is difficult because the construction price is a big question mark. It is difficult for a developer to develop with an open construction budget because the buyer has to lock the price in. There is a certain advantage for well-capitalized large developers who have a construction company in the group.

Developer input costs are rising, which means an increase in sales prices. However, the sales prices of new dwellings have been rising very fast for two years now, decreasing the availability of housing. Making the income-price ratio significantly less favourable for the consumer means fewer purchases.

However, the need for housing will not disappear. Less ability to buy housing means expanding the rental market in both the short and long term, both in terms of rental demand and supply.

Residential rental investors have to accept lower cash flow returns. However, in close-up, they earn quite well from property appreciation. It is a matter of how property appreciation and the uninvited guest inflation, which is feared to last longer than expected, relate to each other.

We hope that Russia, as an aggressor, will find an unworthy end and that the war will end as soon as possible. Hopefully, the economic picture will then become clearer, and the real estate market will be able to be examined for a longer time.

———————

Crowdestate is one of the first real estate crowdfunding platforms, established in early 2014.

Start your real estate investment journey by signing up on Crowdestate to access a wide range of pre-vetted real estate investment projects.

Do you have questions about real estate crowdfunding? Here is our blog post about 7 things you should know about it.