Reading time: 5 min.

What does the expected rate of return mean?

Cash flows received from crowdfunding projects can vary greatly – for example, the proceeds and timing of cash flows from equity investments shall depend on the success of implementing the business plan. For the apartment building development, overly slow sales and increasing input costs may constitute a significant risk. However, the opposite may also occur: the input costs might be stable, but the market situation allows selling apartments faster than expected despite increasing sales prices.

For loans with a set repayment schedule, there is more clarity, but repayment discipline may both increase and decrease the rate of return. It all depends on whether the late payment interest rate is the same as the interest rate of the loan or differs from it.

In both cases, investors are interested in the expected rate of return as the making of investment decisions depends on it. Crowdestate uses the XIRR function, known from spreadsheet programs, to calculate the expected rate of return. As sums received from the project may vary in size and time, the XIRR function allows calculating the internal rate of return for an irregular cash flow.

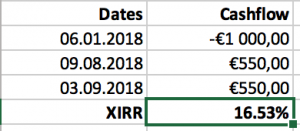

Example

Let us assume that we invest EUR 1,000 in an equity project on January 6th. The market is more active than expected, and the Project Owner is able to make the first repayment of EUR 550 euros already on August 9th and the last repayment, also of EUR 550, on September 3rd.

The rate of return calculated with the XIRR method is 16.53%, but we just managed to increase our initial investment by 10%. Which number is the correct one?

In fact, both calculations are correct, but they show different things. The return on investment (ROI) shows the amount of money we have earned compared to the initial investment. XIRR presumes that the investor has constant access to similar projects – in simpler terms, if the available capital can be reinvested into a project with a similar rate of return, the investor will earn 165.3 euros in interest income on 1,000 euros in one year. Therefore, XIRR considers both the time of receiving the money and the amounts, based on which it finds an interest rate converted to an annual basis, by which the value of the investment increases. Therefore, XIRR is a discount rate that, when implemented, allows us to see the current value of all cash flows.

Loan interest and internal rate of return are different

In the case of crowdfunding offers with fixed interest rates, the assessment of the expected rate of return is generally quite precise. For example, in the exited L. Koidula 32 (II) crowdfunding offer, the interest rate was 11%, but the final and actual rate of return was 11.05%. The L. Koidula 32 (II) crowdfunding offer was unique due to the full bullet repayment schedule, which minimized the difference between the interest rate and the actual rate of return.

When financing the operating capital of Global Nord Timber (III), the Project Owner asked investors for a EUR 400,000 loan for up to seven months at a 15% interest rate. Monthly repayments would consist of 28,000 euros plus current accumulated interest. The last payment would be 260,000 euros plus interest. Assuming that all payments take place according to schedule, the rate of return of the project would be 16.1% with the XIRR method. This is slightly higher than the agreed 15% interest rate because the XIRR method assumes we can reinvest the repaid money under the same conditions each month.

The expected rate of return on equity projects

For equity projects, Crowdestate provides three possible scenarios: a negative scenario, a base scenario, and an optimistic scenario. With all three scenarios, the cash flows of the project are assessed from a conservative, probable, and optimistic viewpoint, and the expected rate of return is calculated based on these assessments.

The expected rate of return is, therefore, a function of Crowdestate’s best assessment of possible proceeds.

XIRR calculation example

Here are some tips if you are looking to calculate the rate of return of your portfolio yourself using the XIRR method.

Insert the dates in the first column and the investment sums in the second. The picture below shows that investment amounts can be positive or negative. The generally used logic states that when making an investment, we give the money away, thus negatively affecting the amount of money we have. Therefore, investments are marked as negative. Incoming money (repayments of the principal amount, interests, and late payment interests) are marked as positive because they increase the amount of money we have.

In order to calculate the long-term XIRR of your portfolio, add the current date and balance of the portfolio on the last line. As shown on the sample portfolio below, two investments have been made, four repayments have been received, and there are still EUR 650 to be received. If this amount was received on September 17, 2018, the internal rate of return of this portfolio would be 15.64%. However, every additional day causes the internal rate of return to decrease due to the time value of money – the euro of today is worth more than the euro of tomorrow.

In case you don’t have an account with Crowdestate yet, you can create one here.

Thank you for investing with us!