Reading time: 4 minutes.

Tõnu Toompark, Kinnisvarakool.ee

Overall, the Estonian housing market is in a very good state. Big picture statistical indicators are moving at about the same pace and in the same direction. This means that the housing market has been in a reasonable balance for 4–5 years now. Balance means that the ratio between demand and supply is such that the situation is not significantly inclined towards either the buyer or the seller.

Given the real estate market and the macroeconomics, it could be said from today’s balanced movements that there are no internal divergences in the real estate market that, without shocks from outside the real estate market, could lead to sudden movements in one direction or another.

However, it should be borne in mind that the prevailing forecasts foresee some cooling of the economy and the labour market. It is not likely that these important factors would not interfere with the real estate market in any way.

Demand is based on a strong labour market

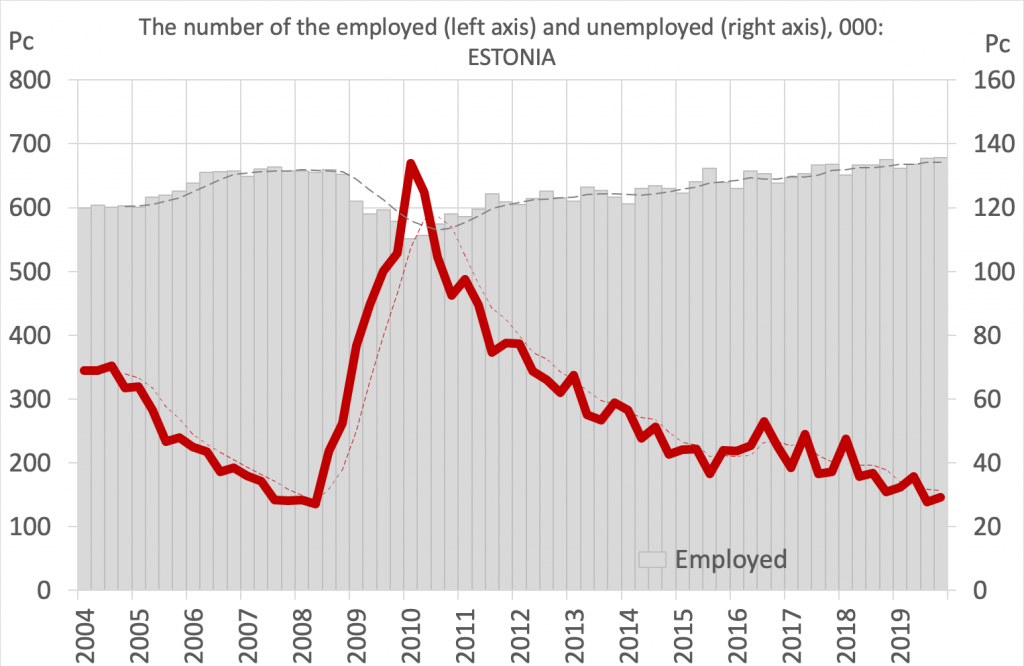

The reason behind the balanced big picture has been a very strong labour market. This means that people have jobs, i.e. employment is close to the maximum. Average wages continue to grow fast and credit conditions are more or less reasonable. In this way, the labour market provides a solid foundation for the real estate market.

Risks to the real estate market would arise, should the labour market begins to crumble. Today’s macroeconomic forecasts from various institutions suggest that some increase in unemployment and a slowdown in wage growth are likely. However, macroeconomic indicators will deteriorate only marginally. This means that there should not be sudden turns in the real estate market.

The supply remains moderately optimistic

In Tallinn, 9,785 transactions were made in the apartment market in 2019. The focus of the housing market in the capital is clearly on new developments. Approximately 2,600 transactions were made with new apartments. This is a noticeably large volume that determines more general trends in the housing market. The housing market of Tallinn, in turn, creates the trends for the rest of the residential sector in Estonia.

Real estate developers are not filled with excess optimism and the developers’ mood is prudent. Competition between providers is intense. At the same time, there is not any significant competition at the level price. In other words, offering discounts does not play a major role in the developers’ marketing communications.

Developers have a strong desire to bring new projects to the market. Launching new projects can get stuck in bureaucracy. For multi-stage projects, launching the next stage is related to the sales success of the previous stages.

The volume of new developments in active offer has decreased rapidly in Kalamaja and downtown. The number of offers at Tallinn’s ‘hills’ continues to increase, but according to some signs, it has passed the peak.

When assessing the supply of housing, it can be concluded that there is a sufficient supply on the market. The level of current offers does not indicate oversupply and thus no significant price pressure. There is a reasonable balance between the number of offers and sales.

The price level seems too high

Housing prices have hit records quarter after quarter. In many ways, however, the rapid rise in the price curve is seeming, as real rights contracts (and thus price statistics) include a fair share of more expensive apartments in downtown and Kalamaja district. Price levels continue to rise and there can be no talk of a fall in prices in the capital, its vicinity, or anywhere else in Estonia.

Buyers, however, consider the price level too high. Fortunately, this cannot be seen in their decisions. Talk of prices that are too high is fuelled by comments from market participants looking for anomalous temporary price peaks.

The reason for the excessively high prices is, among other things, the fact that buyers are looking at new development apartments as the first thing. They can indeed be too expensive for many. Two thirds of the housing market in Tallinn is in the secondary segment, the cheaper segment of older housing.

Comparing the appreciation of equivalent assets over the last 4–5 years, we see that it has risen more or less at the same rate as the average wage increase. Thus, the purchasing power of equivalent assets has remained quite stable. Behind the fact that living space is considered too expensive is a change in demand preferences, or a shift in demand preferences towards newer and expensive apartments.

Risks are around the corner

The economic situation in Estonia is relatively good. The real estate market has also been in balance for many years. It could be estimated that there are no tensions in the real estate market that could lead to sudden radical changes – for example, a fall in prices or the disappearance of transactions.

The risk factors are ‘behind the corner’, i.e. outside the real estate market and outside Estonia. The risk factors of not so much the real estate market, but the Estonian economy as a whole are relatively general. For example, trade wars around the world, continued anomalous interest rate policy, coronavirus, terrorist threat, overall cooling of the European economy, etc.

Coming back to the Estonian real estate market, it is worth thinking about how these risk factors could affect the backbone of today’s active housing market, the labour market.

There are no clouds to be seen in the sky

Assuming that the economic forecasts of public institutions and commercial banks are more or less accurate, the outlook for the real estate market is positive. Some cooling in the economy could leave a mark on the number of residential transactions. There is no reason to expect a significant decline, but 5% of the significantly higher level than the historical average would not be bad.

Price forecasts are also positive. The strong demand in the housing market should remain, even though employment has fallen slightly and wage growth has slowed down a bit. A reasonable increase in housing prices in Tallinn and other major attraction centres could be in the range of 3–5%: somewhere between the consumer price index and wage growth.

This would mean that the value of the assets increases, but transaction prices do not outgrow the buyers’ purchasing power. In other words, the forecast shows a continuation of strong purchasing power. Predicting the continuation of a small price increase also means that, for the most part, home buyers do not have to fear that the assets they are buying will lose value.

Away from the larger centres of attraction, we can see a much higher rate of price increase, even as high as tens of per cent. There, however, the low base value of real estate comes into play, which, despite the rise in prices, remains well below the construction price.

There is still a market for the development of living quarters in larger attraction centres. Buyers prefer a cheaper new apartment that is available to more and more people. Outside of the two or three major attraction centres, the development is incidental and mainly for the construction and development of single-family houses for own use.