Reading time: 1.20 min

Tip: You are able to read more about a specific topic by pressing on the blue parts of the text, which will lead to the articles, blog posts that give you more information.

Graystone investment group defines real estate investment as, “the purchase, ownership, management, rental and/or sale of the property for a profit.” It’s become a popular way to try and earn income in the last few decades, with the exception of the 2008 financial crisis period in the U.S.

Investing in real estate can be highly lucrative, but also highly risky. If you don’t know what you’re doing, or you aren’t careful, financial trouble is a real possibility. People have gone bankrupt from getting in over their heads on their investments and leaving themselves nowhere to turn.

To help you avoid that fate, we’ll go over eight common pitfalls of real estate investing, and how you can do your best to avoid them.

8 Common Real Estate Mistakes

Overspending on books, classes, and similar resources without using them.

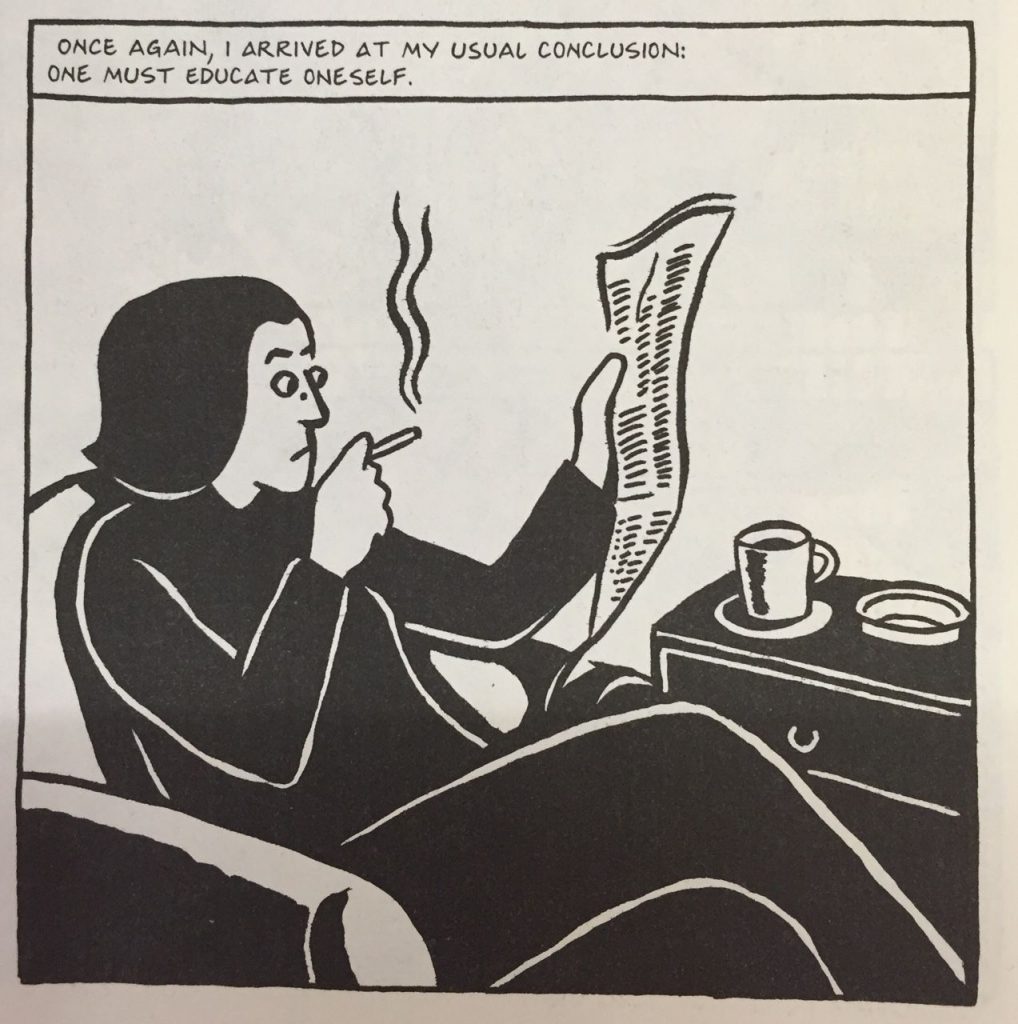

By all means, educate yourself on the field of real estate investment if you have no formal background in it already. Learn the ins and out of the game, the smart ways to buy and sell, and the proper resources and channels you should go through when doing so. However, be as smart about your education as you hope to be about your investments. Buy what you need, then USE it. Don’t just buy a new book or course when you get bored with the one you have.

Jumping in without learning the basics.

This goes back to our first point: education is essential. You don’t want to spend more money on a property than you can make back, or get stuck with it in a bad market and have to pay the mortgage with money you might not have.

Not shopping around enough, OR waiting too long to buy.

You shouldn’t leap at the first property you see without comparing it to others in the area to make sure it’s as good of a deal as you think it is. Look around in different neighborhoods, assess markets and property values, and make sure people are renting there. On the flip side, don’t pass up something you know is a good deal because you’re always afraid that another, better one is around the corner.

Believing you have to be rich to invest in the real estate market.

While it does take some capital to purchase assets, you don’t have to be filthy rich to get started in the world of real estate. Often you can control a property by putting down a fraction of what it’s worth to secure it, then bring in additional income through rent to pay the mortgage and maintenance fees on the property. There are also several crowdfunding platforms you can use to invest in properties for a smaller amount of the total cost (Crowdestate for example).

Getting too attached to a property.

If your end goal is to resell or flip a property, it’s useful not to get too attached to it, or the tenants who you rent the property to because you’ll eventually have to leave them both behind for other investments.

Trying to buy off-market properties that aren’t up for sale.

According to the finance blog Bigger Pockets, there can be a benefit to buying an off-market property in a good area or an area that will see a lot of business soon. However, if a seller knows they’re sitting on valuable property and aren’t already motivated to sell, they may try to gouge you for a higher price than you’d usually pay.

Thinking this will make you rich overnight.

There’s no such thing as an overnight success, and real estate investment is no exception. The best route is the patient one. Start small, learn, and grow your investment portfolio as your skills increase.

Not taking the time to fully analyze a property before buying.

This is among the most serious mistakes would-be investors make, and it can literally ruin you financially. If you don’t have enough money to take on a property, or it doesn’t look like you’ll be able to sell or rent it, you should probably hold off on buying. Don’t rely on shortcuts; know the market you’re buying into inside and out. It’ll clue you into how well your property will perform. If you see an abundance of red flags, walk away.

Keep these things in mind, but remember that they’re only guidelines. Do your research, and make sure you’re thoroughly educated before you invest in a property. It isn’t something to be taken lightly, but done correctly, being a real estate investor can be lucrative.

And a lot of fun! 🙂