Reading time: 4 min.

Let’s take a look back at April 2021 – new, completed and overdue projects, payments made to investors and secondary market transactions.

Successfully funded projects

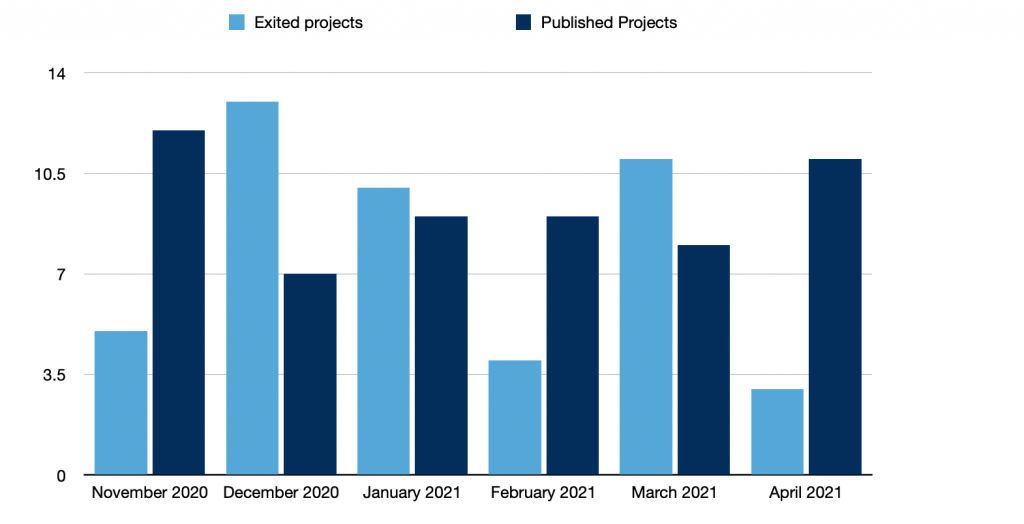

In April 2021, 11 new investment opportunities were launched on Crowdestate’s crowdfunding platform. 5 out of them were Estonian projects, 5 Latvian, and 1 Romanian. A total of 10 projects were funded. The total number of funded projects increased to 325, in the amount of EUR 103 570 451.

New investment opportunities on the platform

Rae põik 6, Rae vald, Harju country, Estonia (V)

Ristiku 3, Pukamäe küla, Kohila vald (I)

Samurcasi 33, Gulia, Tartasesti, Romania

Koru põik 7 (V), Saue vald, Alliku küla

Koru põik 5 (IV), Saue vald, Alliku küla

The average investment amount in April was EUR 377.46. Compared to the last month, the average investment amount has decreased by EUR 29.88.

Exited investment opportunities

A total of 3 successful exits were made during the month of April and the total number of investment opportunities that ended successfully increased to 208.

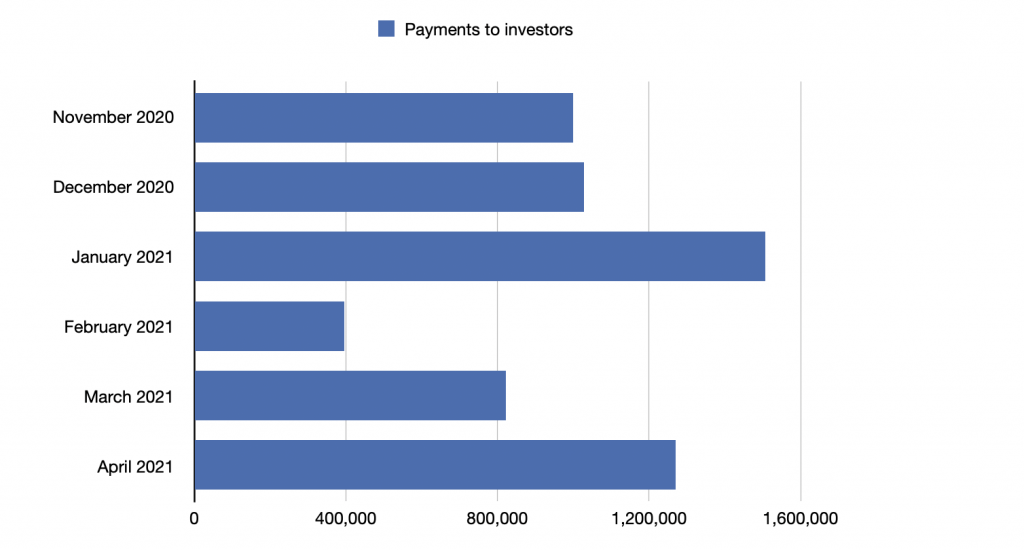

The total amount of EUR 1 117 334.69 was paid out to investors. Including principal repayments totalling EUR 1 081 126.82, interest payments totalling EUR 36 207.47, and late fees in the amount of EUR 0.40.

Successfully exited investment opportunities:

Marketplace statistics

32.67% of Crowdestate investors are active in the secondary market. In April, 784 investment offers were published for sale, in the amount of EUR 616 515.68, and 279 investment opportunities were bought in the amount of EUR 101 386.12

The most-traded project was USL Invest OÜ (II) which was published for sale 94 times. The most bought project this month was Nord Company, which was bought a total of 20 times.

April pay-outs and overdue projects

Repayments to investors were made from 35 different investment opportunities totalling EUR 1 270 025.02 of which EUR 1 181 126.82 were principal repayments, EUR 88 203 interest payments, and late fees in the amount of EUR 695.20.

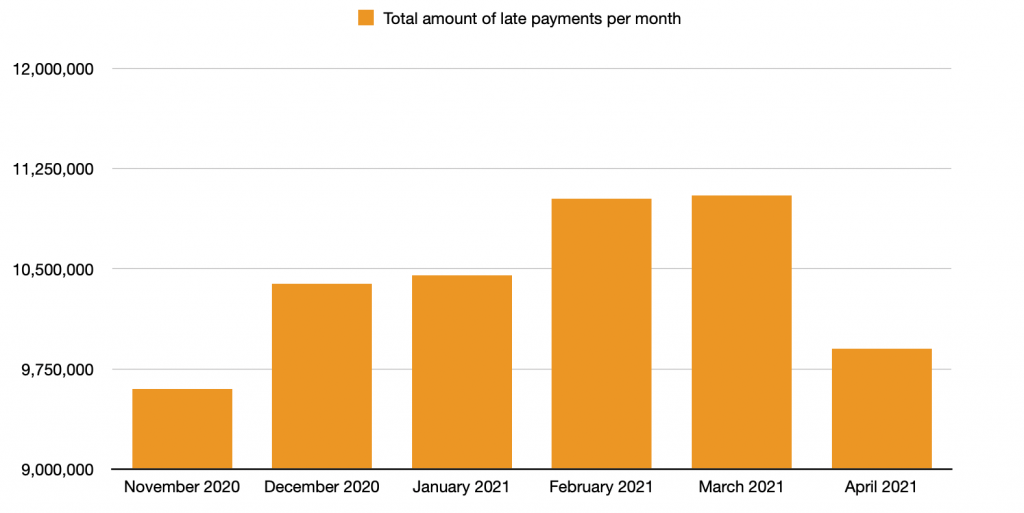

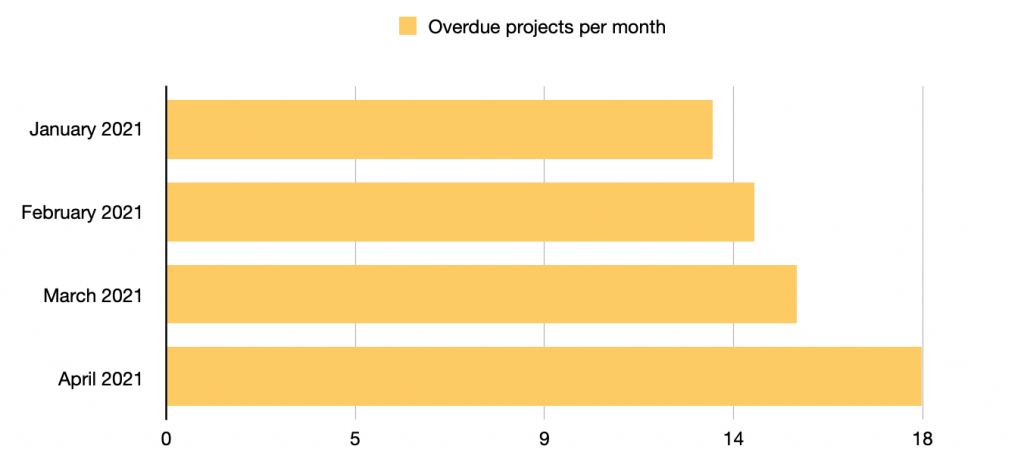

As of May 1st, payments of 18 different projects (including a total of 31 different investment opportunities) had been late, totalling EUR 9 9025 61.37, including EUR 5 270 871.08 principal, EUR 1 502 079.12 interest payments and late fees in the amount of EUR 3 129 611.17.

The total list of overdue projects can be downloaded on our statistics page.

Thank you for investing with us!